colorado springs sales tax calculator

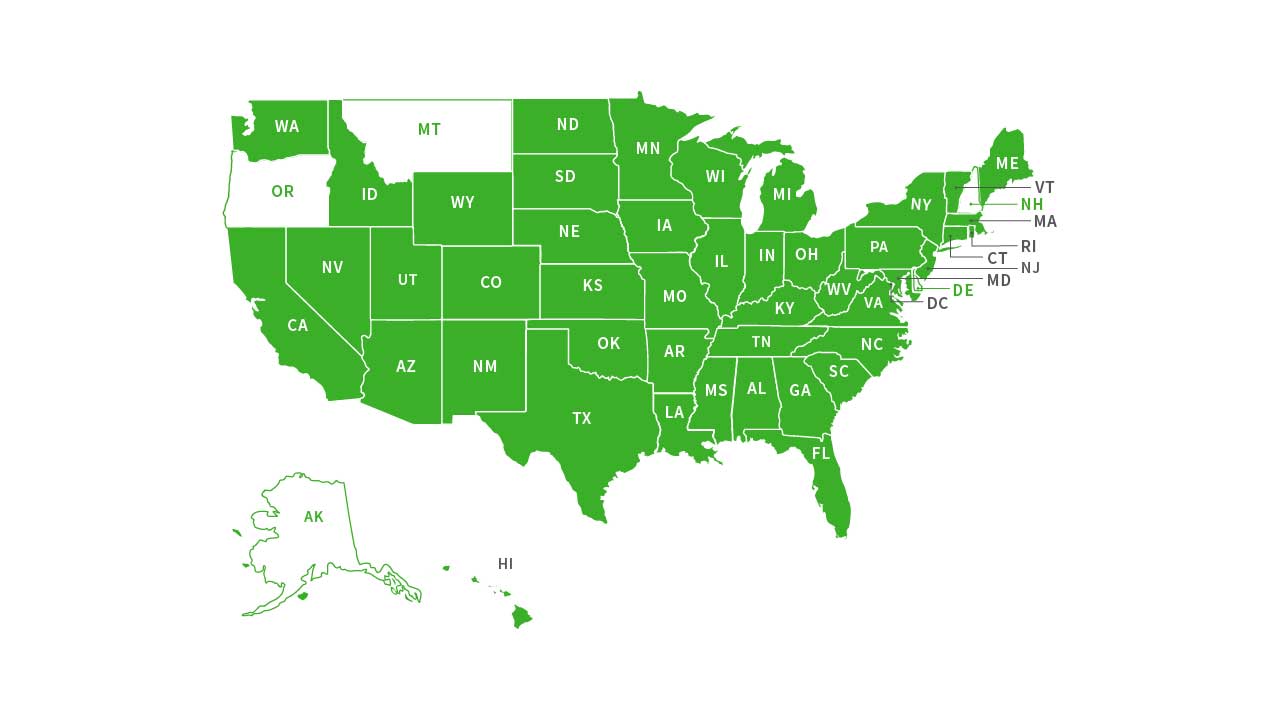

Colorado has 560 cities counties and special districts that collect a local sales tax in addition to the Colorado state sales taxClick any locality for a full breakdown of local property taxes or visit our Colorado sales tax calculator to lookup local rates by zip code. Colorado Springs CO 80903.

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

However as anyone who has spent time in Denver Boulder or Colorado Springs can tell you actual sales tax rates are much higher in most cities.

. Combined with the state sales tax the highest sales tax rate in Colorado is 112 in the cities. Up to date 2022 Georgia sales tax rates. If you need access to a database of all Colorado local sales tax rates visit the sales tax data page.

With local taxes the total sales tax rate is between 2900 and 11200. Click here for a larger sales tax map or here for a sales tax table. Use our sales tax calculator or download a free Georgia sales tax rate table by zip code.

Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3There are a total of 116 local tax jurisdictions across the state collecting an average local tax of 0074. Call the City of Colorado Springs Main 719 385-City 2489. Sales Tax Services.

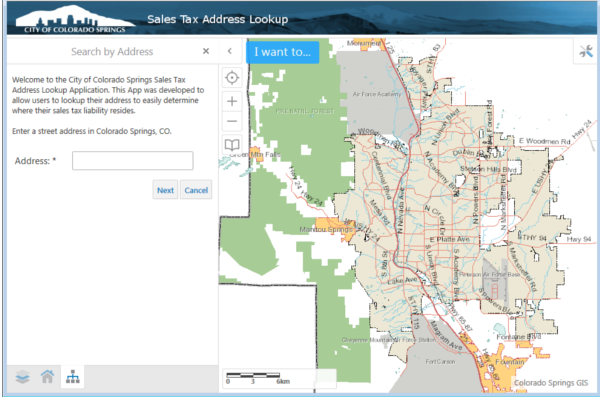

Apply for a Sales Tax License. The City of Colorado Springs has launched an emergency preparedness campaign called COS Ready This campaign provides a series of actions. For more information visit our ongoing coverage of the virus and its impact on sales tax compliance.

With local taxes the total sales tax rate is between 2900 and 11200. The statewide sales tax in Colorado is just 290 lowest among states with a sales tax. Colorado has recent rate changes Fri Jan 01 2021.

This is because many cities and counties have their own sales taxes in addition to the. Please consult your local tax authority for specific details. Up to date 2022 Georgia sales tax rates.

Colorado has state sales tax of 29 and allows local governments to collect a local option sales tax of up to 8There are a total of 279 local tax jurisdictions across the state collecting an average local tax of 409. Colorado Sales Tax. Click here for a larger sales tax map or here for a sales tax table.

Combined with the state sales tax the highest sales tax rate in Idaho is 9 in the city of Sun Valley. The outbreak of COVID-19 caused by the coronavirus may have impacted sales tax filing due dates in Colorado Springs. The state sales tax rate in Colorado is 2900.

Sales Tax Information Colorado Springs

Sales Tax By State Is Saas Taxable Taxjar

Airbnb Rules In Colorado Airbnb Laws Taxes And Regulations The Leading All In One Vacation Rental Management Software For Pros Hostaway

Property Tax Calculator Property Tax Guide Rethority

Calculator And Coins Payroll Taxes Income Tax Preparation Business Tax

The Consumer S Guide To Sales Tax Taxjar Developers

Property Tax Calculator Property Tax Guide Rethority

Wyoming Sales Tax Small Business Guide Truic

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Calculate Cannabis Taxes At Your Dispensary

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Sales Tax Address Lookup Application Colorado Springs

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Sales Tax Information Colorado Springs

Capital Gains Tax Calculator 2022 Casaplorer

Sales Tax Information Colorado Springs